Using contact-level intent monitoring to close 3 critical performance gaps in ABM

As we head into 2020, we will see important improvements in demand visibility with sources we've all been missing.

At the same time that the concept of customer experience seems to be attracting more and more thought leadership press, the stark reality is that in many B2B companies, three critical revenue-maximization efforts remain demonstrably sub-optimized. For ABM practitioners, closing these performance gaps promises to deliver additional improvements to the bottom line.

Part of the problem is that we’re mostly using systems conceived a long time ago. Part of it is due to processes that have been slow to evolve. And part is caused by organizational constructs that have not yet been able to take advantage of clear performance improvement opportunities.

As we head into 2020, I’m super excited by the innovative companies bringing together newly available data insights with the willingness to do things differently. They are leveraging insights from their own first-party data as well as data available from companies like ours (full disclosure) as well as other third-party providers that bring buyer signals and new levels of insight into opportunities and activity like Clari, Idio, G2, HG Insights, LinkedIn and more. They’re addressing long-standing issues in both lead and opportunity management. And they’re beginning to innovate in post-sales areas as well, thereby unlocking potential for critical improvements in cross-sell up-sell yields. Each of these three areas is benefitting from important improvements in demand visibility made possible with new sources of behavioral insight.

Closing the lead-to-opportunity gap

There are two huge pieces missing from our legacy lead-and-opportunity management models – both with multiple components. The first is that leads, as people, are incredibly poor stand-ins from what is actually going on in an account. If you have a known active account, but no leads – a “false negative” – instead of de-prioritizing the account, it means you should work even harder to engage. If you have lots of activity by a single individual, while that certainly tells you something about their particular interests in your content, it actually conveys very little information about the account as a whole. More often than anyone wants to admit, these leads are often “false positives,” the kind of activity that makes salespeople wary of marketing-generated leads altogether. We need to change the criteria used for alerting sales. We need to make it more buying-team based. By showing the actual people engaged on topics relevant to what you sell, high-quality behavioral data can unmask what’s really going on in an account. Right now, leading purchase intent data-based practitioners are currently doing exactly this to prioritize accounts and the readily identifiable buying teams within them.

Yet even when a buying team can be clearly identified inside an account, our legacy lead management processes provide no simple way of retaining that knowledge and passing it along to sales in a timely fashion. If these people aren’t engaged, they can’t “qualify” as leads in the legacy process. And so, at best, they start receiving nurture emails via marketing automation – leaving sales still uninformed of a clear opportunity that’s aging with every passing day. To solve this problem, innovative practitioners are starting to port contact-level intent data right into conversational marketing tools like Conversica, to fill the “non-lead” process gap, obtain engagement and deliver faster clarity to sales. And it’s working! But capturing a single opportunity in a single account is only the tip of the iceberg.

Achieving real account potential demands parallel processing

While the quota system in sales is useful for focusing sellers’ energies on where they’ve already seen success, most companies have yet to balance this against what an account’s potential really is. Admittedly, some accounts are too small to buy more than one of what you sell. And some are in no position to buy an add-on or more of the same any time soon. But then there are a whole slew of accounts where there really are a lot of other potential buying centers for either the same product or a different one your company also offers. (Think about different divisions, different geographies, maybe even entirely different use-cases.)

In most companies, “opportunity creation” in the CRM system is entirely in the hands of the individual sellers. There is no mechanism for documenting the presence of an opportunity without seller involvement. Marketing and sales teams are now using intent and behavioral data to highlight additional active buying centers – for more of the same product or to cross-sell other offerings – inside accounts. They are then using this information to collaborate more closely with sales management to make sure that these potential “at bats” don’t get lost in gaps between how marketing sees demand and how sales teams are deployed and incentivized.

Accelerating opportunities all the way to renewal

In many B2B industries, sellers and buyers alike have been moving steadily towards subscription models. And while this has led to a wonderful rise in customer success practices, little change has filtered back into the opportunity management process itself. Exactly how your deals tend to progress is a critical input for sales managers working on how to optimize deal velocity and closure rates. But the rich information about how sellers win and why they might be losing remains both fragmented in the CRM system or across multiple systems. The problem is especially obvious if we look at the “opportunity object” within CRM.

According to industry experts, the typical “opportunity” in a CRM system references only one person’s name at the prospect account. If captured at all, the actual working status of the “opportunity” is often delegated entirely to the salesperson. It’s their word as to whether it’s at 20% or 60% or somewhere else in between. (For an in-depth look at better ways of doing this, check out GSP).

Leading practitioners have begun to use contact information embedded in third-party purchase intent data to populate key players into the opportunity itself. In this way, sales management and sellers are able to have richer coaching discussions about the actual people on whom a deal’s outcome is likely to depend. This is a great start, but there’s much more to do.

In a technology business, if that first deal process closes with a win, all eyes will immediately move on to the renewal. Despite this shift in focus, and especially if the customer success team is on its own system, much of the insight gained in the original deal process will not be transferred to the Customer Success team. An antidote to this information gap can be created by combining account and contact information from within the CRM and the third-party purchase intent monitoring source directly into the customer success system. In this way, customer success will be able to both look back at what went on with key players in the deal and stay abreast of on-going activity in the account that has bearing on how they should manage the relationship going forward.

Kick-starting account revenue maximization

When a single deal flows into customer success, most of the account handling energy will be dedicated to driving renewal with that team of buyers. At the same time, some significant portion should be reserved for managing the experience of those who were neutral or even detractors in that initial deal. High-quality purchase intent data can contain competitive information critical to this kind of perception management effort. And that’s not only important for the immediate deal in-hand, but this approach also offers significant potential for improving progress with the account as a whole. Here’s how:

In a revenue-maximization strategy, even as customer success is working through onboarding a new set of users, the energized sales team is re-focusing its own attention onto the next opportunity (and the one after that) at the account. Their success at maximizing your company’s share of additional deals will partly depend on how well the combined team succeeds in understanding and managing the needs and sentiments of those who are already getting to know you first hand.

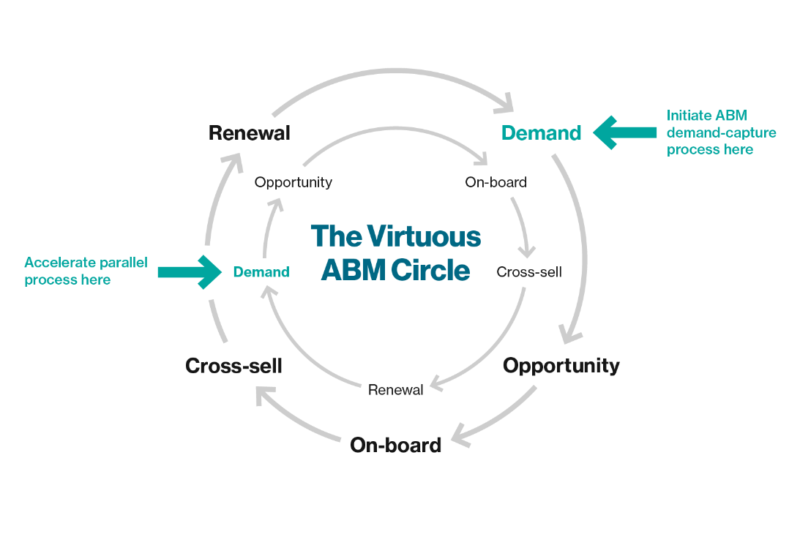

A truly virtuous ABM circle

We’re now truly on the cusp of completing a data-driven virtuous circle that rolls out continuously, starting from better identifying demand, to better managing it, to better leveraging it going forward. New high-quality sources of real purchase intent data deliver an important piece of the solution. The remaining elements involve changes to how we manage and communicate behavioral information across our organizations, processes and actions. I look forward to seeing huge progress in closing these performance gaps across the coming months.

Opinions expressed in this article are those of the guest author and not necessarily MarTech. Staff authors are listed here.

Related stories