Opinions expressed in this article are those of the sponsor. MarTech neither confirms nor disputes any of the conclusions presented below.

Insights to reimagine your holiday 2020 planning

The holiday consumer’s journey starts with search. As the pandemic continues, your brand should be relying on it more than ever.

The Covid-19 effect that has altered our day-to-day habits in 2020 may have its greatest impact on the upcoming holiday shopping season. The question that is top of mind with most businesses: What’s in store for the holiday retail season in 2020?

To help you navigate this uncertain environment here’s five insights we’ve generated at Microsoft Advertising to help your holiday planning:

Holiday retail sales often stay strong even when consumers say they’re cutting back

What people say and what they do sometimes are not in agreement. This is something we find true in a variety of behavioral economic research. One thing to note are the many surveys suggesting people will cut back their spending that aren’t reflective in real life actions. People still shop and celebrate during economic downturns, usually more than they expect to. So, while retail spending may drop this holiday season, it likely won’t drop as drastically as consumers expect or forecast.

Is there historical data backing this? Yes. From past analysis, we saw this behavior during the 2008 financial crisis. Consumers reported they would spend 29% less during the holidays in 2008, though retail sales dipped by only 4.7% in comparison to 2007, the year prior.

Consumer preference for online shopping will boost ecommerce sales dramatically

The shift to online shopping during the pandemic will help provide ecommerce growth well above what was predicted at the end of 2019. While overall retail sales in the U.S. will decrease, online sales will increase significantly across categories. Categories hit hard by COVID-19, such as apparel, are still expected to see ecommerce growth in 2020.

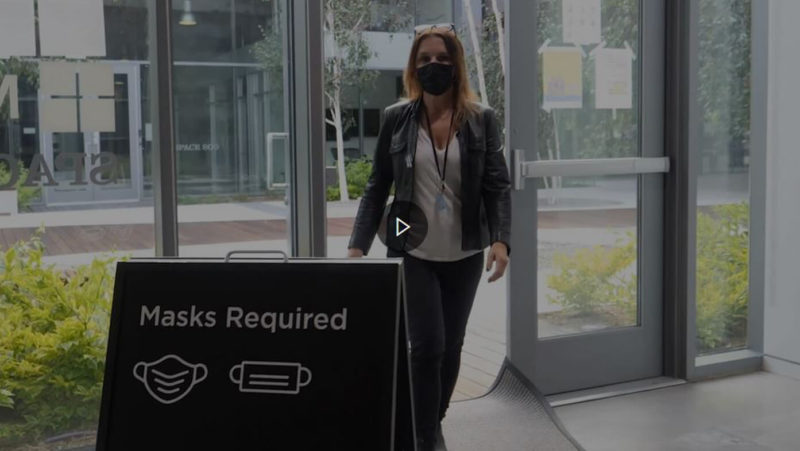

Consumers want contactless shopping

The demand for contactless shopping has been supercharged as consumers prioritize their safety over the in-store shopping experience. There are a few different categories where the physical senses have always been important in the shopping journey. Yet it’s the convenience of touch-free shopping that analysts believe will cause permanent shifts in consumer behavior this holiday season. According to eMarketer, 52% of the U.S. population will use “Buy Online, Pick Up In Store” or what is referred to as BOPIS options in 2020, driving a 60% YoY growth in BOPIS sales. Consumers are also changing their holiday shipping expectations, with 81% expecting expedited shipping options. It’s expected that 44% of U.S. consumers will delay holiday shopping due to expedited shipping options and the expectation that purchases will arrive before the holidays.

Plan your campaign around holiday shopping trends

Remember: Search is where consumers start their purchase journey. In fact, 57% of consumers turn to search when they don’t have a brand in mind, and 91% of searches on the Microsoft Search Network were non-branded in the 2019 holiday season. Make sure your messaging aligns with key holiday shopping phases and customer journey touch points. The weeks leading up to Cyber Week see Black Friday and Cyber Monday sales and promotions, with retailers often teasing products well before Thanksgiving week. And with good reason: Cyber Week draws the most sales and consumer spend of the holiday season. There is still opportunity in search marketplaces. As all industries come back online and supply/chain inventory is refreshed, product demand is outpacing supply in a number of industries. If a business’ competitors do not have inventory to sell, they won’t be bidding because they won’t be able to fulfill orders and don’t want to waste spend on advertising until inventory improves. This presents a great opportunity for lower cost per clicks in many search marketplaces as a whole and specifically in niche marketplaces inside of specific verticals.

People want to purchase from brands they trust

Consumers want brands they can trust. This means being transparent, using your platform to speak out on important issues, and acting in line with your customers’ values. Brands that make a value-based, emotional connection with consumers stand to build customer trust and loyalty. Reaching them via search in an authentic way that highlights your values is key to capturing and maintaining their attention.

While focusing on the first four areas, don’t leave out this important fifth pillar which is asking and answering: “What does our brand stand for?”

For additional business recovery tips and insights on how to answer question number five for your business, watch Episode 1 of The Download now.

Enjoying these insights and want more? Check out this link.

Related stories