Agencies say search, social spend will rise, but increases target 5 platforms

Our survey finds second-tier platforms are much less likely to see spending increases in the coming year. Amazon and LinkedIn crack the top five, while the Google and Facebook duopoly still dominates.

SAN JOSE — Media spending on search and social platforms is expected to increase this year, but increases will be concentrated among a handful of platforms. That’s according to Marketing Land’s Digital Agency Survey 2019, which we released Wednesday at SMX West in San Jose, California.

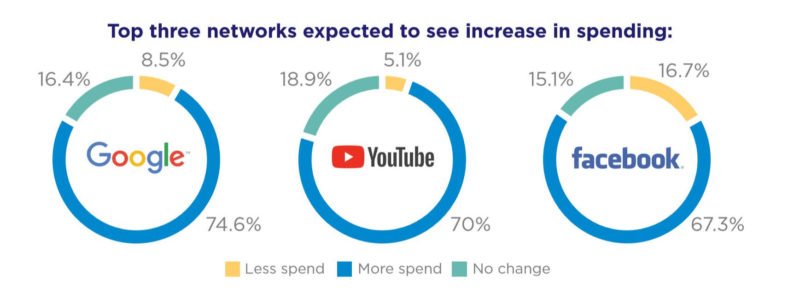

Google, YouTube, Facebook/Instagram, Amazon and LinkedIn are poised to see the biggest gains in ad spend revenues, according to the report. More than fifty percent of respondents forecast increases on each of those platforms, with the so-called duopoly of Google and Facebook leading the way.

Three-quarters expect media spend on Google will increase and seven out of 10 expect to spend more on YouTube advertising in the coming year. Just 8.5 percent and 5 percent, respectively, plan to spend less on Google and YouTube.

[mkto-form-api program=’MTC_1811_DigAgcySur’ campaign=’14571′ form=’9181′ text=’Discover how digital agencies are transforming. Download the eBook now.’ ga=’ga(“send”,”event”,”pdf”,”download”,”digital agency”);’]

Feedback on Facebook ad spending is a bit more nuanced. While expectations for spending cuts were relatively low across all the networks asked about in the survey, Facebook ranked in the top three for both increases and spending cuts, with 67 percent expecting to see increases and 17 percent forecasting cuts.

The survey largely reinforces what we’ve heard from marketers in our previous reporting: that Facebook’s ongoing troubles with data privacy, ad measurement and transparency have not meaningfully dampened advertiser investment. Yet, the 17 percent who do expect cuts to Facebook ad spend indicate that some marketers are starting to look at alternative marketing channels.

Amazon and LinkedIn gaining momentum. Amazon and Microsoft-owned LinkedIn rounded out the top five, with 60.5 percent forecasting higher spend on Amazon and 52 percent on LinkedIn.

Amazon and LinkedIn have both been investing heavily in more sophisticated targeting and measurement capabilities and expanding format and inventory offerings over the past year — and are set to continue investing in their ad platforms. Just 4 percent of marketers surveyed said they expect to see spending cut on Amazon, echoing our Amazon Advertising survey, in which 80 percent of current Amazon advertisers said they plan to increase budgets on the ecommerce platform in 2019. A little more than 8 percent forecast spending cuts on LinkedIn in the coming year.

Challenges for second-tier platforms. Consensus over spending increases dropped off precipitously after the top five platforms.

Thirty-two percent expect to increase spending on Bing, yet 22 percent forecast spending cuts on the search platform. More than one in five agencies also see cuts coming for Twitter Ads.

In the digital audio realm, Spotify appears to be gaining traction over Pandora, with 28 percent of agencies expecting to increase Spotify ad spend and just 10 percent expecting to do so on Pandora.

The attention going to Amazon does not appear to be lifting other marketplaces. Just 12 percent of agency respondents said they plan to increase ad spend on eBay, 9 percent expect to spend more on Walmart/Jet.com and fewer than 20 percent plan to increase ad spend on other marketplaces.

Why you should care. The winner takes all dynamic of digital advertising may be showing (ever so) slight signs of cracks, with Amazon and LinkedIn gaining traction among agencies.

Yet, while smaller platforms that have put a new focus on monetization and advertising — such as Quora and Reddit –may offer advertisers new, less expensive marketing options than the big platforms, our survey underscores the challenges they face in gaining traction. Those agencies that forecast spending increases on some of these smaller networks in the coming year may see opportunities others are missing.

Download the full report here (registration required).

Opinions expressed in this article are those of the guest author and not necessarily MarTech. Staff authors are listed here.

Related stories