US digital ad revenues top $59.6 billion in 2015, up 20 percent to hit another high

The IAB's annual report shows growth continuing to come from mobile, which now makes up 35 percent of search and display ad revenues.

Another year, another record and double-digit growth for digital advertising in the US. Digital ad spend topped $59.6 billion in 2015, a gain of 20.4 percent over 2014’s $49.5 billion, according to the Interactive Advertising Bureau’s annual report conducted by PwC.

The chart below illustrates the 10-year growth in US digital advertising revenues from 2005 to 2015 in which the industry has seen a 17 percent compound annual growth rate (CAGR). 2010 was the year mobile began to play role in US digital ad spend totals. Since then, mobile has seen 100 percent CAGR compared to just 9 percent growth from non-mobile revenue over the past five years.

In the fourth quarter of 2015, digital ad revenues shot up past $17 billion for the first time, up from $14.5 billion in the fourth quarter of 2014. Revenues for the second half of 2015 were $32.1 billion, representing 54 percent of the annual total for the year, which is in line with the revenue split seen in past years.

Revenues still concentrated among 10 ad sellers

Just 10 companies accounted for 75 percent of all US digital advertising revenues in Q4 2015, up from 71 percent the previous year. This tight concentration of revenues in the hands of a few has been one constant in the industry throughout the past decade.

Mobile accounts for 35 percent of search and display revenue

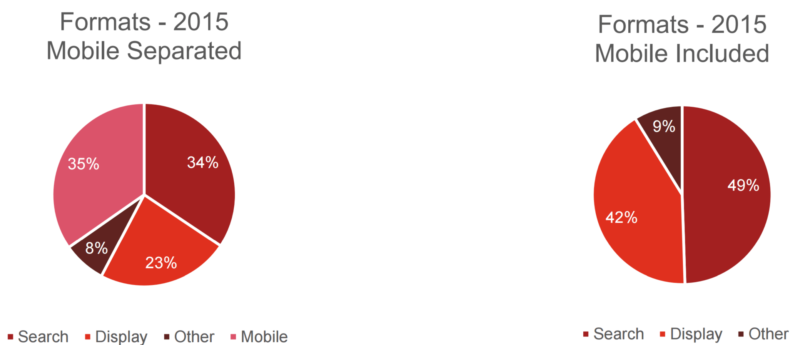

The IAB breaks out mobile separately as its own to include any spending that occurs on mobile, whether its display, search or other, and that can make it a bit awkward to get a full perspective on how channels like display and search are affected by mobile spend. This year, the report shows format results both with mobile separated out as its own (pie chart on the left) format type and with mobile included (pie chart on the right).

When mobile is included (again, right pie), search continues to make up nearly half of all digital spend in the US, with display accounting for 42 percent. Overall, 35 percent of search and display revenues came from mobile, up from 25 percent in 2015.

Social Media ad revenue nears $11 billion

Spending on social media advertising increased from $7.0 billion in 2014 to $10.9 billion in 2015. This includes ads on social network in and social gaming websites and apps across devices.

Social media ad revenues jumped significantly in the second half of 2015, increasing from $4.4 billion in the first half of the year to $6.4 billion in the second half.

From 2012 to 2015, social media adverting has experienced 55 percent CAGR and accounted for roughly 18 percent of all internet ad spending in the US last year, up from 14 percent in 2014.

Digital continues to gain share of US advertising spending

In 2013, internet ad revenues exceed that of broadcast television for the first time, after surpassing cable television ad revenues in 2011. In 2015, digital continued to gain share, closing in on the total spent on all television spend (broadcast and cable).

“Internet advertising was a disruptive innovation when the industry was formed,” said David Silverman, partner, PwC US in a statement. “Twenty years later we still see double-digit growth rates, including 20 percent in 2015. Three key disruptive trends – mobile, social, and programmatic – continue to fuel this exceptional rate of growth.”

Opinions expressed in this article are those of the guest author and not necessarily MarTech. Staff authors are listed here.

Related stories