SurveyMonkey adds mobile analytics to its resume

The new SurveyMonkey Intelligence offers free and premium accounts for accessing data from hundreds of thousands of participating mobile users.

SurveyMonkey is expanding on the meaning of its name.

Not the “monkey” part, of course. With the recent launch of SurveyMonkey Intelligence, the online survey-taking firm is now utilizing automated data collection of mobile device owners to provide large-scale samples about how they use their devices.

The data is acquired through panels of hundreds of thousands of US-based mobile iOS and Android users, who agree to download an app that anonymously transmits their usage stats in exchange for access to the same data.

For instance, vice president Abhinav Agrawal told me, they might discover how many times they use their Facebook app on a daily basis. They might also get such incentives as access to a virtual private network for sending data securely.

The mobile panels were first launched in 2014 by mobile startup Renzu, co-founded by former Zynga executive Agrawal and acquired by SurveyMonkey last year.

He added that the resulting mobile analytics — including usage and retention data, leaderboards, demographics, user base overlap, app affinity, average revenue per users and app downloads — are part of the company’s mission to “help our customers make great decisions.”

The kinds of decision-making, Agrawal said, could include making an ad buy in a particular app, deciding whether to develop a competing app, or even whether to buy the company behind a given app.

SurveyMonkey is getting into mobile analytics following its layoff last month of about 100 staff members, or about 13 percent of its total employee roster. Although the company says it is financially healthy, the layoffs were apparently the result of disappointments in its business-focused products.

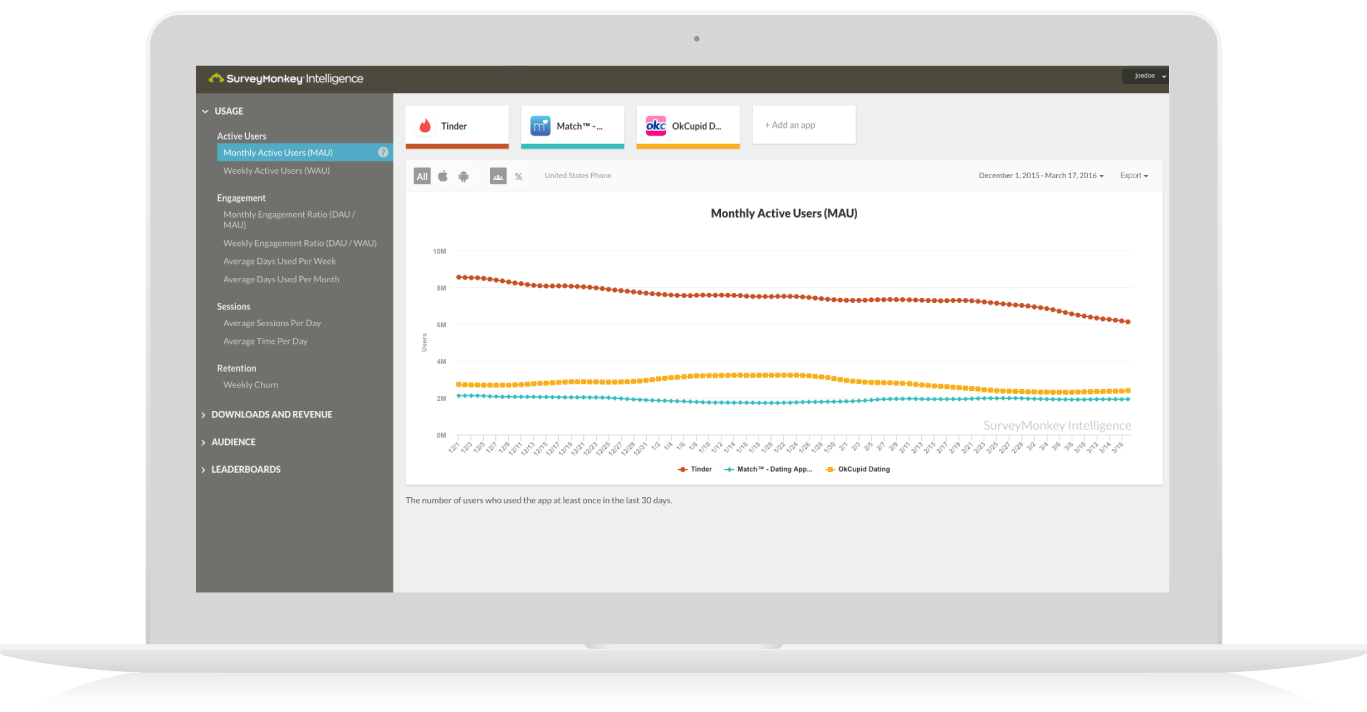

As one example of the kind of comparative analytics Intelligence can offer, Agrawal pointed to some insights it showed about the popular dating app, Tinder.

Tinder is bigger than the rest of the dating app world combined, including Match, OKCupid, Hinge and Bumble App, but its users are rapidly declining, from about seven million in mid-February to 5.7 million at the end of March. And, although it has many more users, Tinder’s revenue per user is not much higher than Match’s or OKCupid’s.

Given that mobile is a booming platform, the space already contains a healthy supply of mobile analytics providers. Agrawal noted that some analytics providers, like Mixpanel or Flurry, focus on providing data to publishers about their own apps. Among those that offer comparative analytics, App Annie is the largest. But, he added, no one else offers free access to comparative data, with a premium offering above that.

He also pointed to SurveyMonkey’s 15 years of experience in acquiring, analyzing and presenting data — the company says it processes three million survey responses every day — and its unique and large sample of panelists.

Opinions expressed in this article are those of the guest author and not necessarily MarTech. Staff authors are listed here.

Related stories