Segment adds more data sources besides apps and sites to its hub

The company, which focuses on connecting data to analytics tools, also adds out-of-the-box business intelligence reports from partners.

When it began in 2012, Segment (formerly Segment.io) had one purpose in life: take data from mobile apps and web sites, and make them easily and consistently available through its hub to a handful of analytics tools, like Mixpanel, Hubspot and Google Analytics.

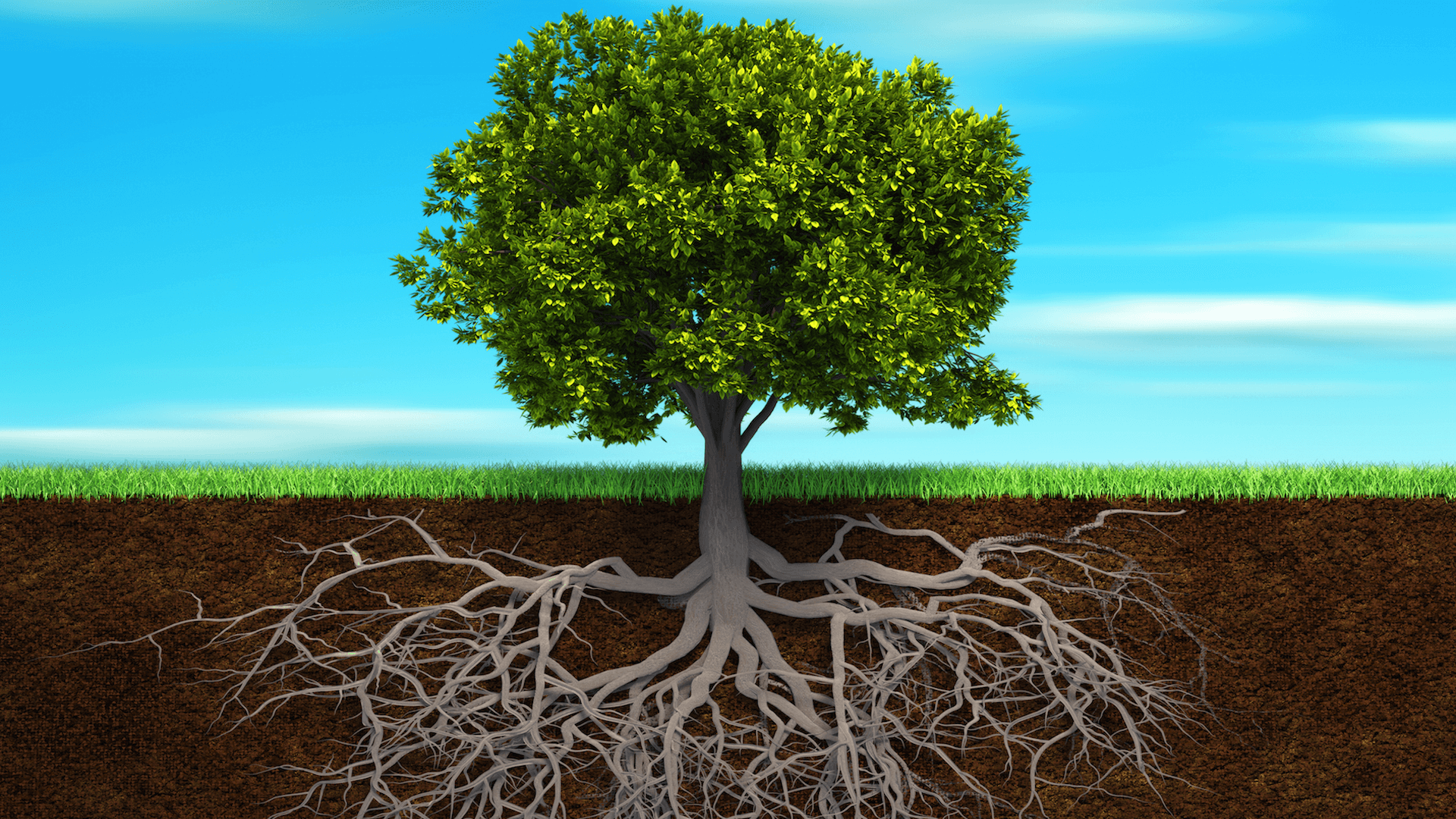

You could visualize it as a tree, CEO and co-founder Peter Reinhardt told me. The trunk had a couple of roots — apps and sites — and they fed a handful of branches, the tools.

As it evolved, Segment added branches — that is, tools for such purposes as attribution and A/B testing — until it supported more than a 100. At some point, he recalled, tool makers started calling Segment to set up integration, instead of the other way around, until more than 200 tools were supported.

Segment then added the ability to send the info to a data warehouse, where it could be analyzed by a business intelligence (BI) application. The BI application, Reinhardt said, was like another analytics tool, but there were still only two roots — data from sites and apps — going to dozens of branches.

Today, Segment is announcing a new product called Sources, which, to continue Reinhardt’s metaphor, begins to expand the number of roots in the company’s tree.

The new sources of data, besides apps and sites, now include customer relationship management (CRM) system Salesforce, help desk Zendesk, payment platform Stripe, email marketing vendor MailChimp, transactional email providers Sendgrid and Mandrill, customer feedback platform Intercom, inbound marketer HubSpot and cloud communications platform Twilio. Other sources will be added regularly, the company said.

The data can be imported with a single click by a non-technical user and can include such data as support tickets, payments or email campaigns.

It can be sent to a Postgres database or an Amazon RedShift data warehouse service, where it can be queried and visualized in out-of-the-box reports by tools from business intelligence providers Chartio, Mode, Looker, Zendesk’s Bime or Periscope Data.

For instance, a business might better understand the relationship between an online customer support conversation and a purchase. Or it might compare data to learn how much revenue is actually generated from each specific email campaign.

A business could itself build the data capture from the sources’ APIs, Reinhardt acknowledged, but it would involve coding to handle the particulars of each API, as well as translation, structuring and routing.

“We see ourselves as the pipes and reservoirs of the data,” he said.

This allows more complex comparisons, he pointed out, than the simple data piping through an automated workflow that is offered by, say, workflow automation service Zapier.

In that case, for instance, the data about a customer indicating dissatisfaction through a Zendesk ticket would automatically be sent to a customer support channel on Slack.

Startup Usermind is trying to be Zapier plus business intelligence package Domo, but Reinhardt said that Segment makes it easier and quicker for a business to set up data capture and routing that compares any kind of data, while Usermind is focused more on processes and workflows.

Opinions expressed in this article are those of the guest author and not necessarily MarTech. Staff authors are listed here.

Related stories