Are our leading brands also optimization leaders?

Are well-known brand name e-tailers taking advantage of the tools available for optimization? Columnist Brian Massey shares his analysis of 7 top sites.

As I soar 35,000 feet above the Amazon jungle, my thoughts turn to the attentive audience I addressed in São Paulo, Brazil, this week. The attendees were executives and professionals from Brazil’s largest online businesses. These online retailers — brought together by Compasso, a UOLDIVEO company — sold everything from apparel to books to shoes to men’s clothing, and even college degrees.

Some would argue that the Brazilians are behind North America and Europe when it comes to online tech. In my experience, online businesses run from the US are still scaling the learning curve when it comes to conversion optimization. But how much do our market leaders focus on website optimization?

Several of the attendees to my workshop agreed to let me review their websites during the presentation. You may have seen me do these live critiques at events in the past.

As a part of my review, our host Alexis Rochenback asked each site representative to provide the name of a well-known business in the same category, to give us a frame of reference. These reference accounts were mostly US brands that are leaders in their industry. What I found by digging into these reference sites gave me interesting insights into their sophistication levels, when it comes to optimization. I’ll share my findings here.

While it’s tempting to look at a competing site and critique what you see on the page, I have learned that you can’t really know what is working for a brand just by looking at the site. What you can see, however, is the software that they have installed. I’ve demonstrated this in previous articles.

Given that these companies are leaders in their marketplace, one would expect them to have a full suite of sophisticated tools on their sites. Well, it turns out that’s not exactly the case. Here are some of the reference accounts I looked at and what I found.

The tools

When evaluating websites, I use a tool called Ghostery to snoop on the JavaScript that loads with the site. Most data-gathering tools have a JavaScript signature, called a “tag,” that tells us that the tool has been installed on the site.

This doesn’t mean that the marketing teams at these companies are using the tools, but installing them is a step in the right direction.

In my analysis, I’m focused on tools that can be used to learn about the visitors to a website. Most of these sites have an abundance of tags. However, the majority are there to support advertising networks.

What I want to know is which of these companies is the most curious about their visitors — curious enough to install the right tools.

Analytics

Every site is going to have some form of analytics software installed. Google Analytics is the most common package, even for these high-traffic sites. Next in line is Adobe Analytics.

Any site that doesn’t have an analytics package installed doesn’t deserve the revenue they are generating. All of the reference sites had one or more analytics tools installed.

Aggregated user interactions

A number of tools on the market can track each visitor’s mouse movements and scrolling behavior.

The most common output of this software is a “heatmap” report, showing where the visitor’s mouse has traveled and where they have clicked.

Individual user interactions

We can learn a lot by watching individuals use the site. Today, several tools allow us to record individual sessions as our users interact with the website. This lets us see where they may be having difficulties researching and buying.

Surveying and feedback

Many great hypotheses come from just asking our visitors what they liked and didn’t like about their experience on our site. Several tools exist for injecting questions into the experience to get user feedback.

Performance tools

These tools are focused on improving the load time and response time of a website. They find features that are slowing the site and chasing away impatient visitors.

Tag managers

I highlight the existence of tag manager software on the sites simply because it indicates a higher level of commitment to managing the tools that generate visitor insights.

A/B testing tools

At the top of the maturity model lies split testing, or A/B testing. This is a difficult discipline, but it provides the most accurate measurement of how a change to the site will impact sales.

These tools make conversion optimization possible.

How did these brands do?

In the graphics that follow, the big purple boxes are the output of the Ghostery browser plugin that snoops on websites and exposes the JavaScript tags installed on them.

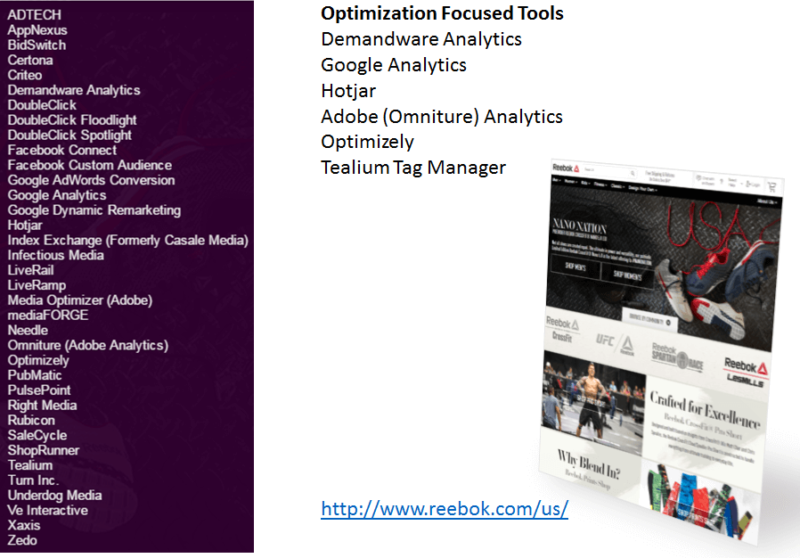

Reebok

Reebok.com shows a complete suite of tools, including Optimizely A/B testing.

Reebok has a pretty complete set of tools.

This tells us that Reebok has a commitment to developing well-informed hypotheses and to testing those hypotheses against real users.

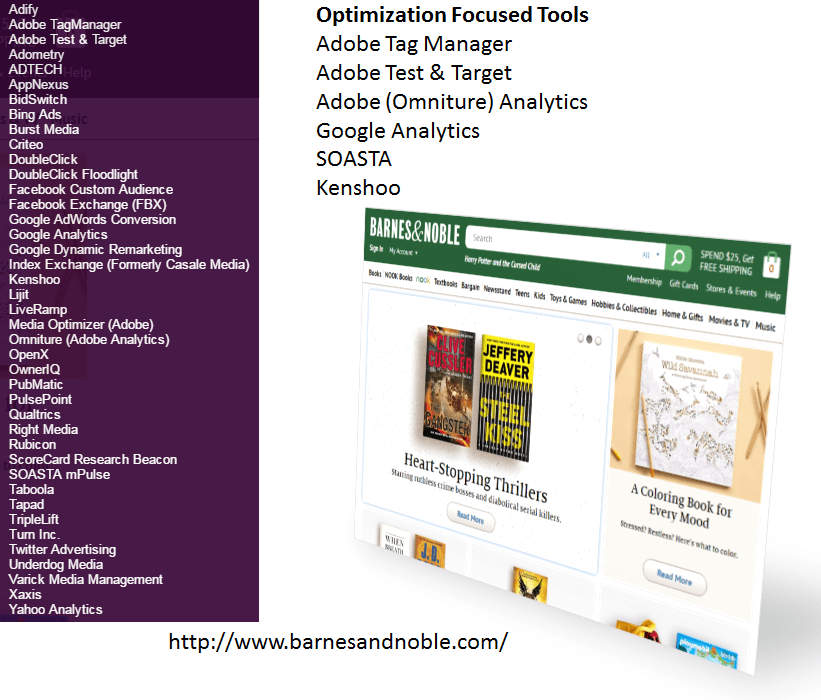

Barnes & Noble

Barnes & Noble lacks tools for analyzing visitor experiences, such as click-tracking and session recording software. They do have a full suite of Adobe tools, including Adobe Test & Target (now Adobe Test).

Barnes & Noble also has SOASTA performance monitoring tools installed.

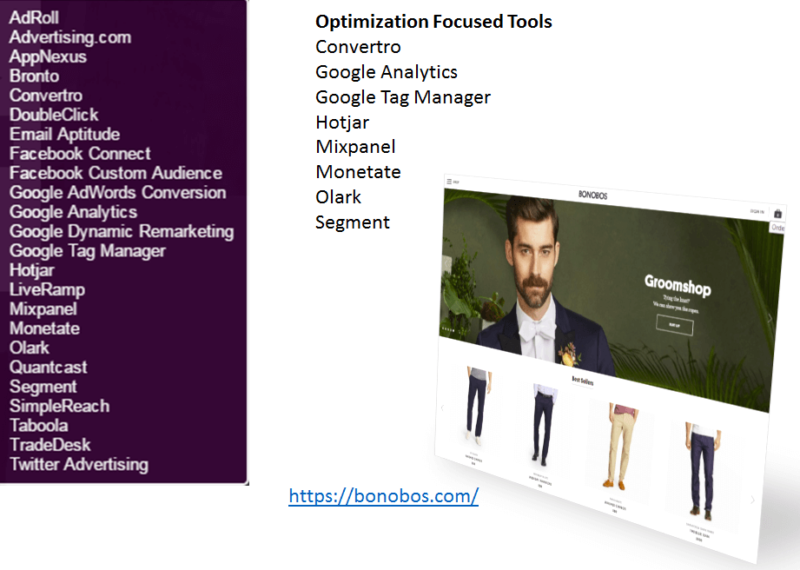

Bonobos

Bonobos.com is an apparel retailer and displays a variety of analysis and optimization tools.

Both Google Analytics and Mixpanel are implemented on the site. Hotjar provides click-tracking and session recording. Olark offers user feedback questions. Monetate offers A/B testing and personalization. Other tools high on the sophistication ladder include Google Tag Manager, Convertro and Segment.

If you’re competing with Bonobos, you have your work cut out for you.

Nixon

Nixon.com primarily sells watches on its retail site. It must not take much analysis to sell watches; at least they don’t think it does.

The site has Google Analytics and Hotjar installed, but no A/B testing tools. This is surprising for a site with traffic above 300,000 search visitors each month. New Relic is a performance optimization tool.

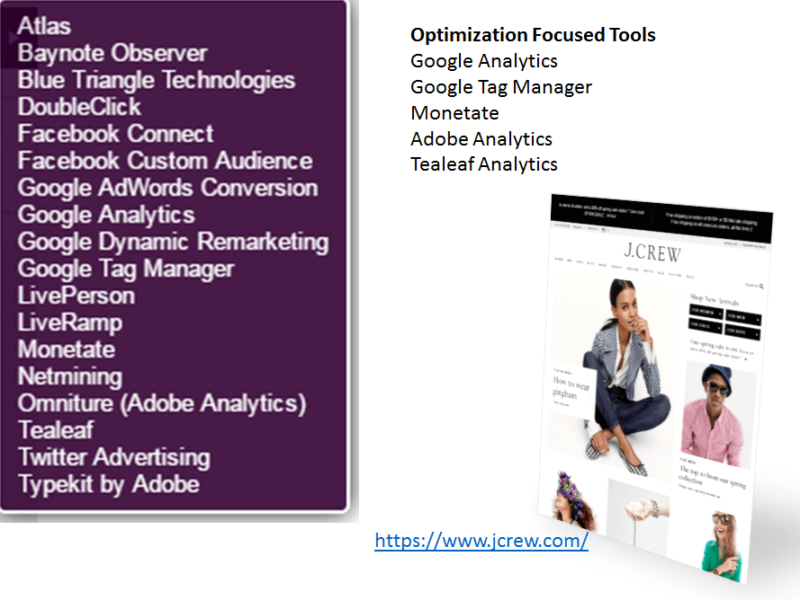

J. Crew

JCrew.com offers a wide catalog of clothing and apparel. We see three kinds of analytics software installed and the use of Google Tag Manager.

Monetate offers testing and personalization for the site. I think J. Crew would benefit from some more user experience tools, click-tracking and session recording.

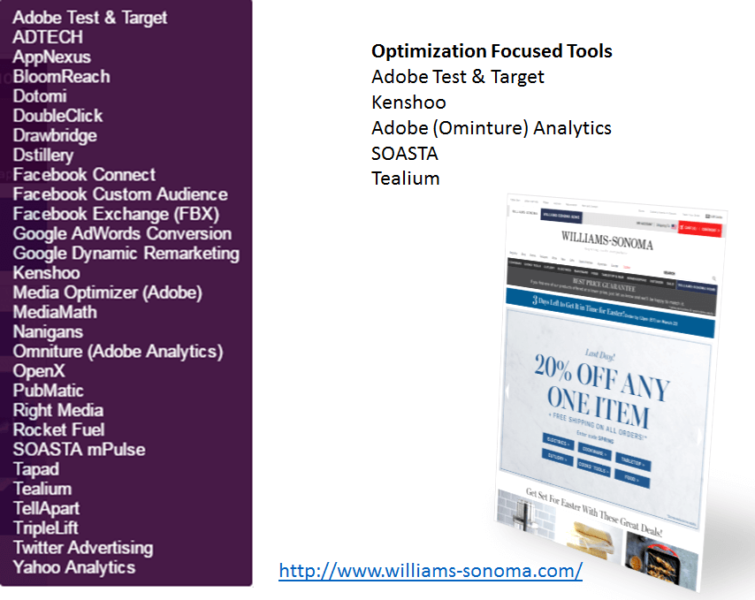

Williams-Sonoma

According to their 2014 stockholder letter, 50 percent of Williams-Sonoma revenue is generated through their ecommerce site. This is a $4.7 billion company. So they should have some scratch for tools.

They do have a rather complete optimization environment, including A/B testing, analytics, performance optimization and tag management. It’s not surprising that they are doing so well online.

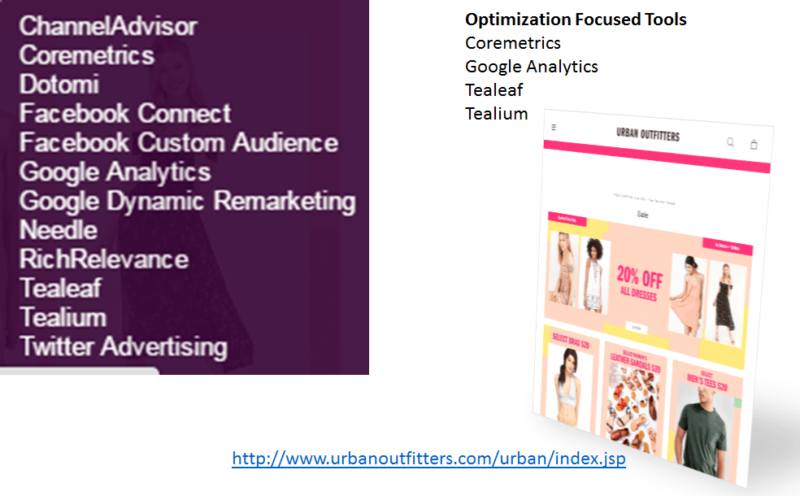

Urban Outfitters

With sales approaching $4 billion, Urban Outfitters should be able to install the tools and hire the team to optimize the site.

They have the enterprise analytics tool, Coremetrics, installed, as well as Google Analytics, Tealeaf and Tealium. Urban Outfitters is making a significant investment, though I’m surprised that we don’t see any A/B testing software installed.

Summary

Of the seven brands cited here, all have invested in analytics. Only two don’t show A/B testing tools, a sign of online immaturity in these brands. Hotjar, an inexpensive all-in-one click-tracking, session recording and visitor feedback tool, is well represented here.

All in all, I feel that our domestic brands are taking optimization seriously, which isn’t surprising since every one-percent increase on conversion rate can mean millions of dollars in additional yearly revenue.

Opinions expressed in this article are those of the guest author and not necessarily MarTech. Staff authors are listed here.

Related stories