Identity resolution spend projected to reach $2.6B in 2022

Changes in cookie availability, location data and privacy regulations make ID resolution solutions more important than ever.

We’ve just released our Martech Intelligence Report on enterprise identity resolution platforms, which has been updated for 2021 with the latest trends, analysis and profiles of vendors in the space. Be sure to check it out! In the meantime, read on for a preview.

Identity resolution platforms, which create and maintain databases of persistent individual and/or household profiles based on multiple first- , second- and third-party data sources, are important tools to help brand marketers overcome the obstacles preventing them from understanding and targeting their audiences with relevant messaging.

U.S. marketers are expected to spend $2.6 billion on identity resolution programs by 2022 – a 188% cumulative increase over four years, according to a Winterberry Group forecast. The growing investment underscores the key role that identity programs play in customer experience and people-based marketing initiatives.

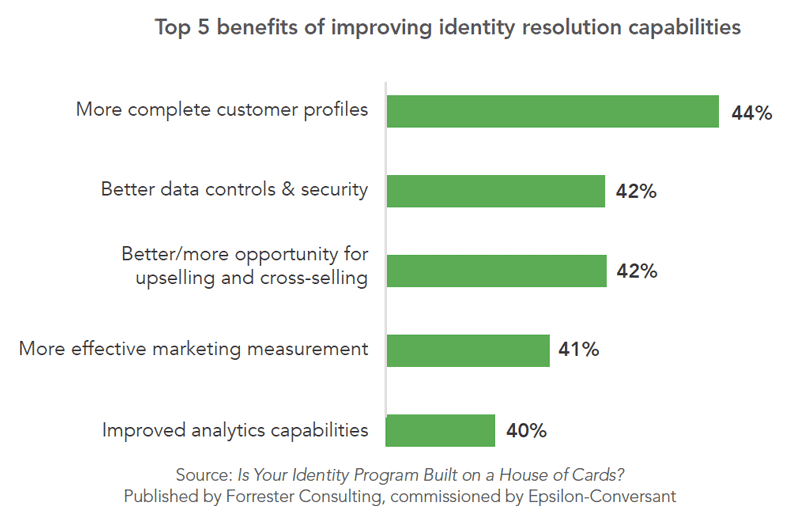

Two-thirds of marketers say their identity resolution strategies have been in place for more than a year, according to Forrester, and many have begun to see strong return on their investments. More complete customer profiles and better data controls and security are the top two benefits of improved identity resolution capabilities.

Yet even as more brands implement identity resolution strategies and technologies, there are still significant challenges to their success. Customer data is scattered throughout the enterprise, often residing in silos that hinder marketers’ ability to develop and nurture relationships.

A consumer might use different identifiers to research something on one device (i.e., desktop cookie or login name), call on another (i.e., mobile phone) and then buy something in the store (i.e., loyalty ID or credit card). Each of these identifiers can live in a different department with disparate collection and matching requirements.

Marketers also are losing access to some forms of data, including third-party cookies and location, a result of Google and app developers providing more tools to protect consumer privacy. Just 11% of Android users and 10% of iOS users agree to share location data with apps, an analysis of 744 million mobile users by Airship found in mid-2020. That’s a fairly small percentage even though one-time and foreground permission options seem to have raised opt-in rates during the pandemic.

Losing data like this is no small blow. A survey of 259 marketers conducted by Phronesis Partners on behalf of Epsilon found 80% reported being “very” or “moderately” reliant on third-party cookies, while fewer than half of those surveyed (46%) feel “very prepared” for the upcoming changes.

For more on the trends driving interest in identity resolution, as well guidance for buyers including in-depth vendor profiles, download our Martech Intelligence Report now.

Related stories